YOU INVEST. WE visualize.

Your Perfect Investment Companion

Stocks

We aim to have coverage of a multitude of markets. Currently we support tickers from NASDAQ, NYSE, and AMEX in the USA. As well as Nasdaq Baltics – covering the Estonian, Latvian, and Lithuanian markets.

ETFs

Why stop with Stocks, ETFs are a popular investment vehicle. We support ETFs traded in all our supported Exchanges.

Dividends

When it comes to Stocks, it is more than just the value – Cashflow matters! We give you a dividend calendar where you can see how your cashflow looks like.

Crypto

More and more people are investing in Cryptocurrencies, but that is often not tracked along with the rest of the portfolio – well, it is here.

Real Estate

One of the most significant forms of investment many do, why not track it with the rest of your portfolio.

Precious Metals*

Like to invest in Gold? Silver? Platinum?

Why not track that value along the rest of your holdings.

* In development feature

Not just another app

Built by investors, for investors

This is not just an app which we made to solve some imaginary problem. All parts of this platform were built to solve issues we and other investors faced getting an overview of our portfolios.

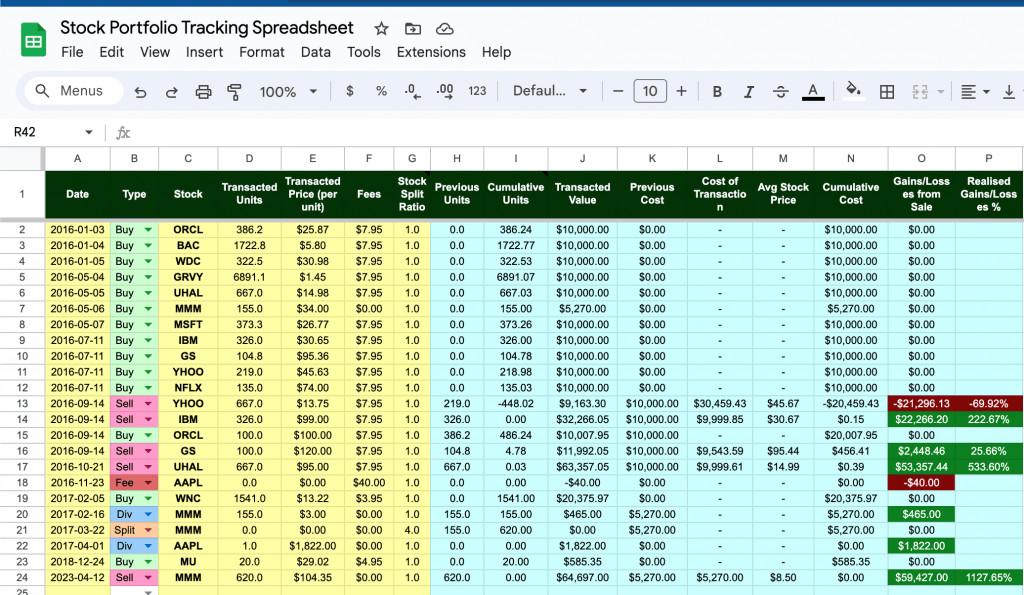

Its 2024, about time we move away from manually maintained spreadsheets

simple data ingest

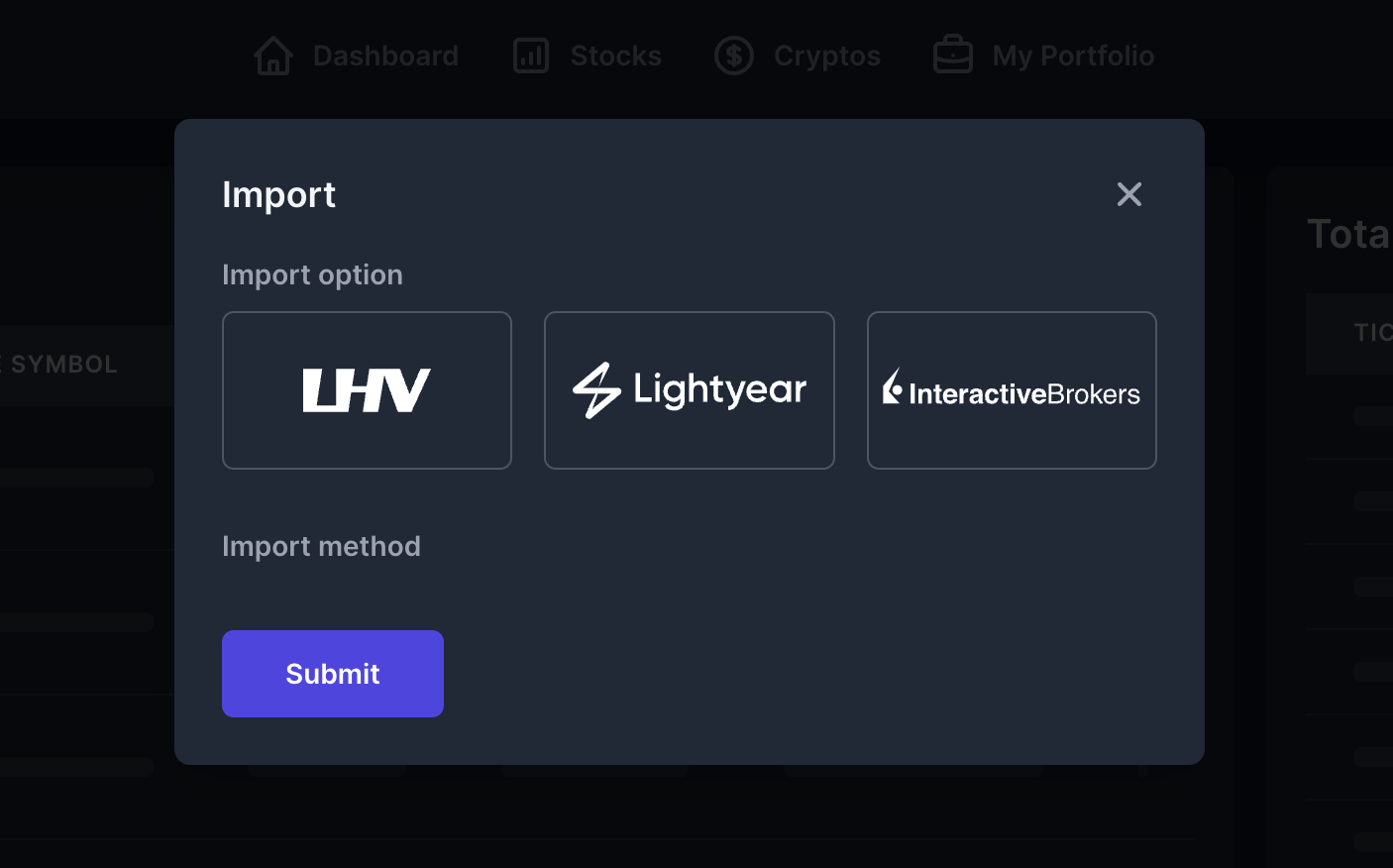

Import your transactions

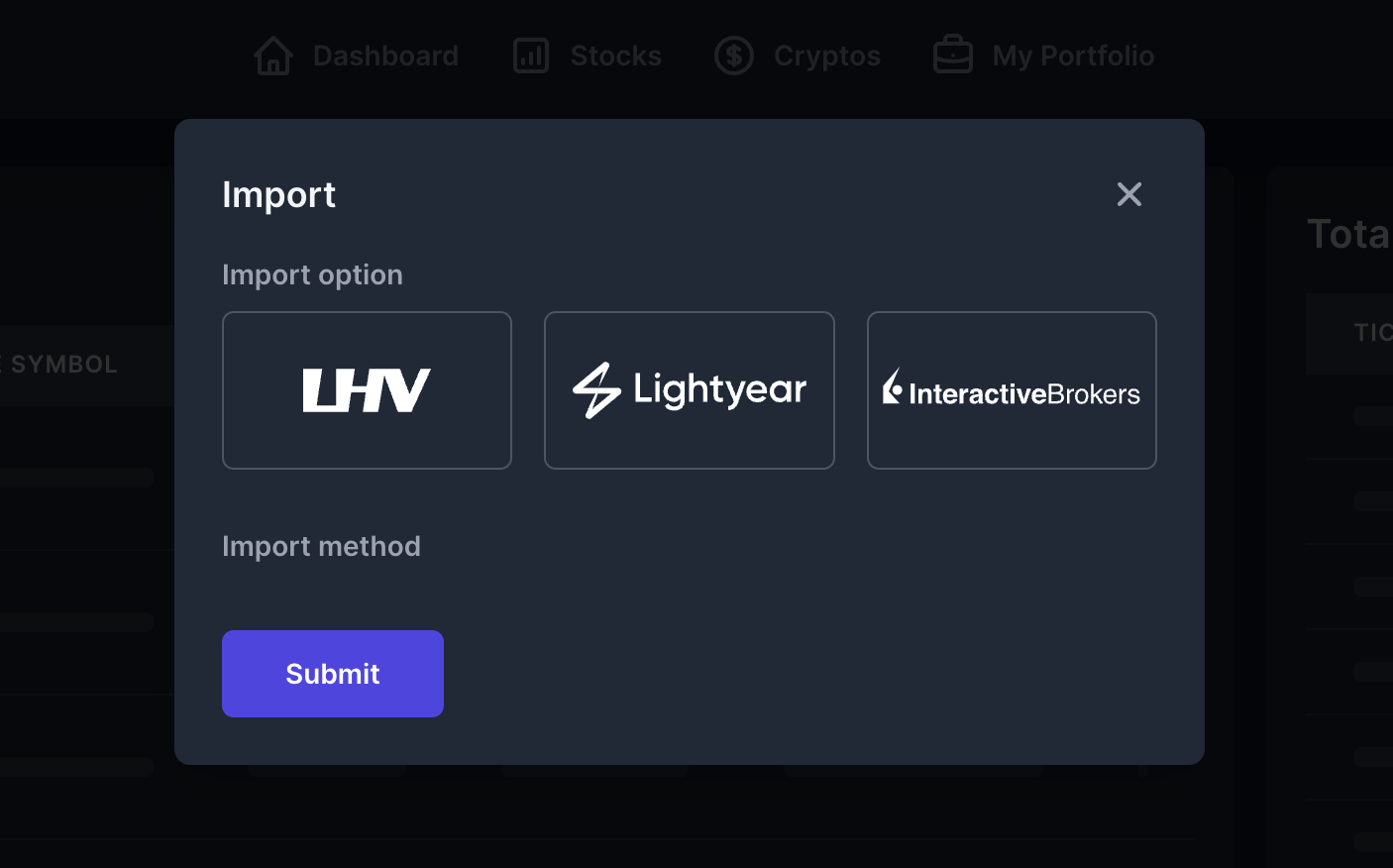

Rather than having to manually enter your trade history into the platform, you can simply import CSV’s from our ever-growing list of supported import formats!

We currently support LHV, Lightyear, and Interactive Brokers’ CSV formats.

A Place to Learn

A community to learn and grow

We are not just providing a platform to track your portfolio, but also a community you can join to learn, share, and grow your knowledge in the financial domains.

You don’t need to be an expert to join, you just need to have the desire to learn!

Who are we?

Meet the team

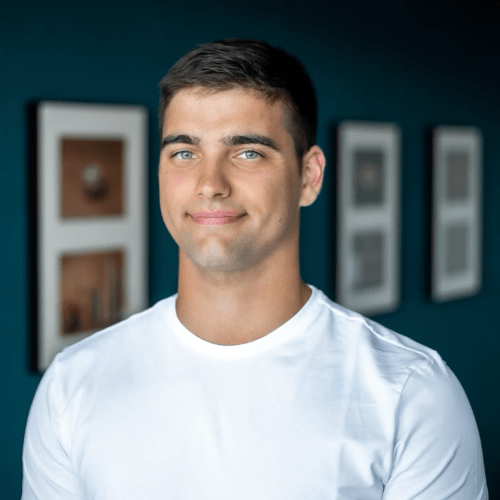

Aaditya Parashar

Co-founder & CEO

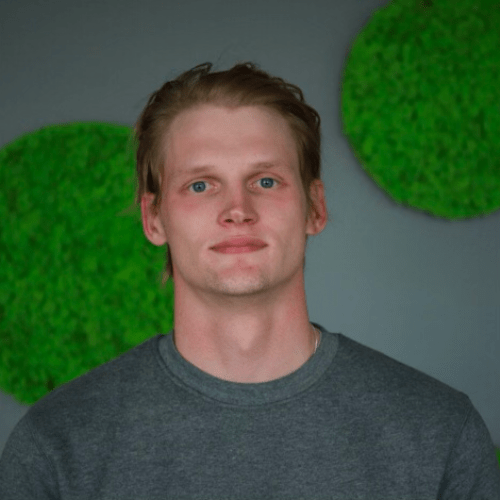

Karl Markus Jõgila

Chief Product Officer

Ott Gridassov

Head of Sales & Community

Reijo Olavi Komu

Co-founder & CTO

SIMPLE & Transparent

Pricing Plan

We wanted to keep it simple – We don’t sell your data, we don’t have Ads.

Subscriptions are the way we can continue to run & develop this platform.

The Early Bird

Free Trial

€ 4.99/month + VAT after that

- Stock portfolio – All supported regions

- Access to dividends & yield calculation

- Access to Cryptocurrencies module

- Access to Real Estate module

Try 30-days risk free. No Credit Card required.

Our blog

-

April 2024 Update: Dividends redefined

We have been live for just over fifty days now, and during that time we have kept working towards gathering…

-

·

Importing your Portfolio

We shall briefly go over how you can import your transaction history from supported brokers into your Wealth Beacon portfolio.…

-

·

Hello from the Team!

Welcome to Wealth Beacon! We are excited to have you here. This being the first blog post we make, we…

perhaps you have such a question

Frequently asked questions

How do I add an investment to the app?

To add an investment, use the ‘Modify’ button in the Stocks and Crypto sections, or the Import button in the ‘My Portfolio’ section for bulk additions.

For Real Estate investments, you need to first add the property in the section, and then enter incomes and expenses associated with it.

What types of investments does the app support?

We support various investment types including Stocks, ETFs, Cryptocurrencies, and Real Estate.

We offer different levels of support for each investment type. For example, Stocks and ETFs are available from six different exchanges, while for Cryptocurrencies, the app tracks the top 100 traded currencies at the time.

Can I export my investment data for tax purposes?

No. We do not offer the functionality to export investment data for tax purposes.

This is due to the complexity and variety of tax laws that apply differently across various jurisdictions. Therefore, the app does not engage in any tax-related activities to accommodate these diverse legal requirements.

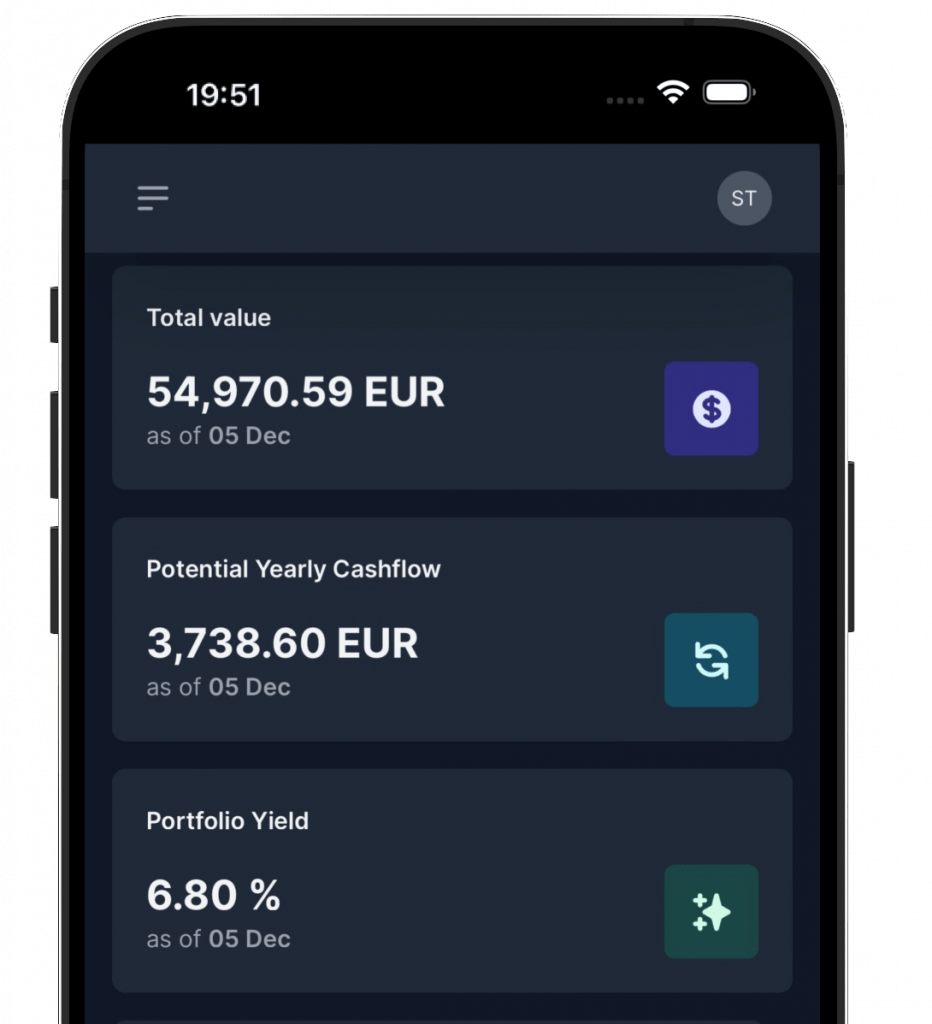

What is the “Potential yearly cashflow” and how is it calculated?

“Potential Yearly Cashflow” is our estimate of the annual income you can expect from your investments. Cashflow is the net amount of money moving in and out of an investment.

At our platform, for stock investments, we calculate this by gathering dividend information and estimating the dividends you’ll receive based on your specific portfolio and transaction dates. For real estate, we determine it by calculating the net cashflow, which is the property’s income minus its expenses. This gives you a clear projection of what your investments could yield over the course of a year.

Can I import my current investment data?

Yes, we allow the importation of existing investment portfolios via CSV files.

The platform currently supports CSV imports from specific investment platforms such as LHV, Lightyear, and Interactive Brokers. As investment platforms have their own unique formats for account summaries, we are continually expanding its support to include more formats, enhancing the ease of integrating your investment data into the app.

Can I track multiple investments within the app?

Yes. You can track a variety of investments such as Stocks, ETFs, Crypto, as well as Real Estate investments.

Is my financial data secure on the app?

We prioritise the security of your financial data and personal privacy. The app is designed to request minimal personal information and focuses solely on transactional data for portfolio management.

It does not store sensitive details such as bank account numbers or payment information. All payment processing is handled through a secure third-party processor, ensuring that your payment details remain protected and separate from the app.

We also follow best practices in technical security and development, all in all this makes the security of the platform and your data our first priority.

How often does the app update market prices for my investments?

We update market prices for investments several times a day using a variety of data pipelines. The frequency and source of updates depend on factors like the type of investment, the market, and other variables. While the app does not provide real-time data, it aims to maintain up-to-date information for effective tracking purposes. This approach ensures that users have reasonably current data for their investment monitoring needs.

What is the “portfolio yield” and how is it calculated?

The “portfolio yield” on our platform is calculated as a percentage, representing the annual cashflow in relation to the total value of your portfolio.

This metric is designed to give you a clear understanding of the overall performance of your investments, reflecting the income generated compared to the portfolio’s total worth. It’s a useful tool for assessing the effectiveness and profitability of your investment strategy.

How do I contact support if I encounter an issue?

We are a small team, so we don’t do dedicated phone or email support. Best way to reach out to us is via our Discord Community – we have a special help channel just for answering your questions!

Question not answered above? Message us via discord →

Ready to start your journey?

It is time to elevate your financial dashboard.